The Single Strategy To Use For Baron Tax & Accounting

Table of ContentsA Biased View of Baron Tax & AccountingHow Baron Tax & Accounting can Save You Time, Stress, and Money.The smart Trick of Baron Tax & Accounting That Nobody is Talking AboutThe Of Baron Tax & AccountingThe Greatest Guide To Baron Tax & Accounting

And also, accountants are anticipated to have a decent understanding of mathematics and have some experience in an administrative role. To end up being an accountant, you have to contend the very least a bachelor's degree or, for a greater level of authority and competence, you can become an accountant. Accountants need to likewise meet the strict needs of the accounting code of method.

The minimum certification for the CPA and ICAA is a bachelor's degree in audit. This is a starting factor for refresher course. This makes certain Australian company owner get the ideal feasible financial guidance and administration feasible. Throughout this blog site, we have actually highlighted the big differences in between bookkeepers and accounting professionals, from training, to functions within your business.

Baron Tax & Accounting Fundamentals Explained

The services they supply can make the most of profits and support your funds. Services and individuals must consider accounting professionals a critical aspect of financial planning. No bookkeeping firm uses every service, so guarantee your experts are best suited to your details requirements.

(https://www.awwwards.com/baronaccounting/)

Accountants are there to compute and update the set quantity of cash every staff member obtains regularly. Bear in mind that holidays and healths issues influence payroll, so it's an element of business that you must constantly update. Retirement is additionally a substantial component of payroll administration, especially considered that not every employee will intend to be enlisted or be eligible for your business's retirement matching.

The Buzz on Baron Tax & Accounting

Some loan providers and investors need crucial, strategic decisions in between the company and investors complying with the meeting. Accounting professionals can additionally be present right here to aid in the decision-making process.

Little companies typically encounter distinct economic obstacles, which is where accounting professionals can provide indispensable support. Accountants use an array of solutions that help businesses remain on top of their financial resources and make educated choices. digital tax agent for individuals.

Accountants make certain that workers are paid precisely and on time. They determine pay-roll taxes, handle withholdings, and make sure conformity with governmental laws. Handling incomes Handling tax obligation filings and payments Tracking staff member advantages and deductions Preparing payroll reports Proper payroll monitoring avoids issues such as late payments, inaccurate tax filings, and non-compliance with labor laws.

The Facts About Baron Tax & Accounting Revealed

This action decreases the threat of mistakes and prospective penalties. Tiny organization proprietors can rely on their accounting professionals to take care of complex tax obligation codes and laws, making the declaring process smoother and a lot more effective. Tax planning is one more essential solution given by accountants. Reliable tax obligation planning entails strategizing throughout the year to decrease tax obligation liabilities.

Accountants help small organizations in determining the worth of the business. Approaches like,, and are used. Accurate assessment aids with selling the company, securing car loans, or attracting investors.

Describe the process and response inquiries. Fix any type of discrepancies in documents. Overview company owners on finest methods. Audit support helps companies experience audits efficiently and efficiently. It minimizes stress and mistakes, making certain that companies satisfy all necessary laws. Legal compliance involves adhering to regulations and guidelines connected to company great post to read operations.

By establishing reasonable financial targets, companies can assign sources effectively. Accountants overview in the implementation of these methods to ensure they straighten with the organization's vision. They frequently review plans to adapt to altering market problems or business growth. Danger management includes recognizing, assessing, and mitigating risks that can affect a business.

A Biased View of Baron Tax & Accounting

They help in establishing up interior controls to avoid fraud and mistakes. In addition, accountants advise on conformity with legal and governing requirements. They make sure that organizations follow tax obligation laws and industry policies to stay clear of fines. Accountants likewise suggest insurance policies that supply security versus potential dangers, making certain the organization is safeguarded versus unforeseen events.

These tools assist small businesses keep accurate records and simplify processes. It assists with invoicing, pay-roll, and tax obligation preparation. It offers numerous attributes at no price and is suitable for startups and tiny organizations.

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Melissa Joan Hart Then & Now!

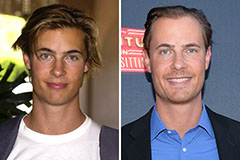

Melissa Joan Hart Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now!